Investing Guide - Denmark

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries,

suggestions, or stock picks, expressed or implied herein, are for informational, entertainment or educational

purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Key terms:

Types of Taxation

Aktieindkomst - 27% on the first 56.500 DKK (56.500 DKK in 2021) / 42% above that (Taxation on stocks and most ETFs / Mutual funds)

Kapitalindkomst - ≈38% Capital gains tax - Tax on bonds and some special case ETFs

Taxation Methods

Lagerprincippet- Assets get taxed at the end of the year - taxed on unrealised profits - taxation occurs yearly

Realisationsprincippet- Assets get taxed at sale (when profits have been realised) - taxed on profit

The amount the assets are taxed by depends on what tax rules it classifies under

ETFs are always taxed through the lagerprincip, however only some are taxed through aktieindkomst

The ETFs on skat’s approved list are the ETFs which are taxed through aktieindkomst

List of ETFs which are taxed through "aktiebeskatning" (List directly from SKAT)

Online list - Easier to read

(Courtesy of Morten Helmstedt)

ETFs which are not on SKATs approved list are taxed through kapitalindkomst (Capital Gains Tax)

As aktieindkomst has a lower tax rate (27% up to 56.500DKK) it is generally best to focus on this tax first, however, above this amount, you pay 42% tax where you can then make the case that capital gains tax would be a better bracket to be in (37% tax)

Danish mutual funds (Danske investeringsforeninger) are taxed the following way:

If they

meet SKATs requirement (They need to pay a certain amount of dividends on returns) then they are taxed based on the

realisationsprincippet

If they

do not SKATs requirement (They need to pay a certain amount of dividends on returns) then they are taxed based on the

lagerprincippet

Note: The reason why relisationsprincippet is highlighted with green and lagerprincippet with red, is due to taxation through realisationsprincippet giving a better return when all other factors stay the same (Expense ratio, tracking error of an ETF and or mutual fund, ETC) - Lagerprincippet makes it harder for returns to compound

Different investment accounts in denmark

Aktiesparekonto is a completely separate account you can open through some banks which have different tax rules

- Aktiesparekonto is an account where you can invest through, where you benefit from paying less taxes (Always 17% tax)

- You can deposit a total of 100.000 DKK to your aktiesparekonto in total and you can invest in stocks or skats positive ETFs on the list

- The aktiesparekonto is it's own eco-system, this means that none of the returns on your assets will count towards your other taxes - This also means it will not count towards the topskat bracket

- On the aktiesparekonto you can invest in stocks, mutual funds, and ETFs from SKATs approved ETF list

- The aktiesparekonto is always lagerbeskattet - This tax is paid on a different day and is not filed on your annual tax summary (In 2021, the tax was due the 15th of january)

- Parents can also create an Aktiesparekonto for their children (At the age of 0)

Aldersopsparing is a retirement account in denmark (Similar to Roth IRA in the US)

- In the Aldersopsparing you pay the PAL-tax, which is a 15.3% yearly tax (lagerprincip) on all securities

- In the Aldersopsparing you can deposit a maximum of 5,400 DKK a year, however, when you have 5 years or less until you retire, you can deposit 52,400 DKK yearly (You can still deposit this amount after you reach retirement age)

- If you do decide to withdraw your funds from the account before your retirement age - you have to pay a 20% fee on all the funds in the account

- In the Aldersopsparing you can invest in all standard types of investment products (ETFs have to follow the UCITS regulatory framework)

- Parents can also create an Aldersopsparing for their children (At the age of 0). The same rules for adults applies for kids (Max 5,400 DKK a year)

Ratepension is a retirement account in denmark (Similar to a 401k in america)

- In the Ratepension you pay 15.3% tax every year, through the lagerprincip on all securities

- In the Ratepension account you can deposit a maximum of 58,500 DKK a year. This amount is TAX DEDUCTIBLE

- If you withdraw your funds before your retirement age - you pay a 60% fee on all the funds in the account

- In the Ratepension you can invest in all standard types of investment products (ETFs have to follow the UCITS regulatory framework)

Børneopsparing is an investment account for children between the ages of 0-14

- In a Børneopsparing account you pay 0% in taxes

- In a Børneopsparing account you can deposit a maximum of 6,000 DKK a year (changes with inflation) and a maximum amount of 72,000 DKK (You can only pay into the account until the age of 14)

- The Børneopsparing account can be withdrawn at the age of 14 and has to be withdrawn by the age of 21

- In a Børneopsparing account you can invest in all standard types of investment products (ETFs have to follow the UCITS regulatory framework)

Livrente is a "retirement account" similar to the ratepension - some would argue that it is closer to an insurance product than a retirement account

Kapitalpension was the old name for the aldersopsparing and has been discontinued - It is no longer possible to pay into this account.

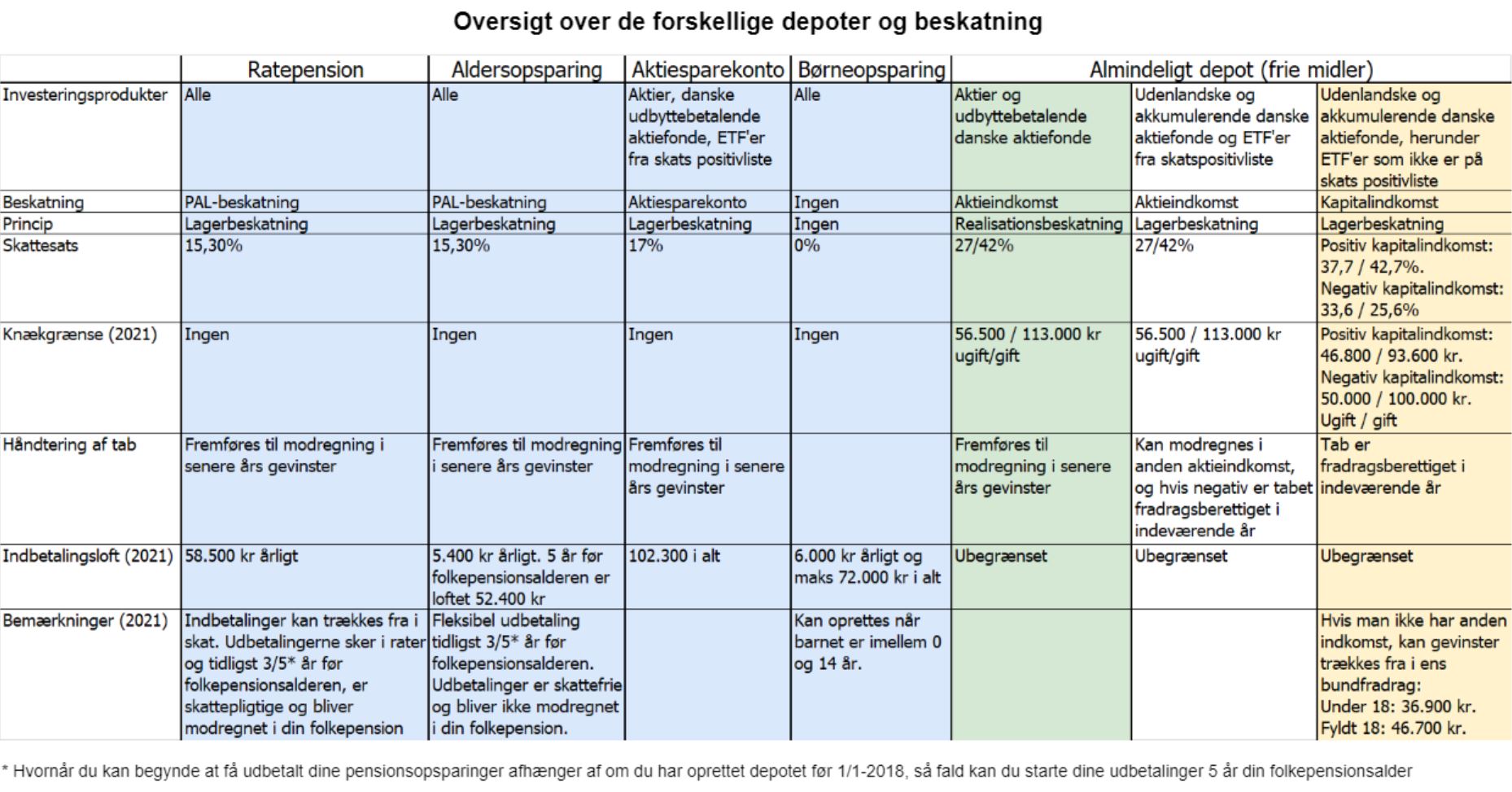

Overview of different accounts (In Danish):

Courtesy of Neovitami

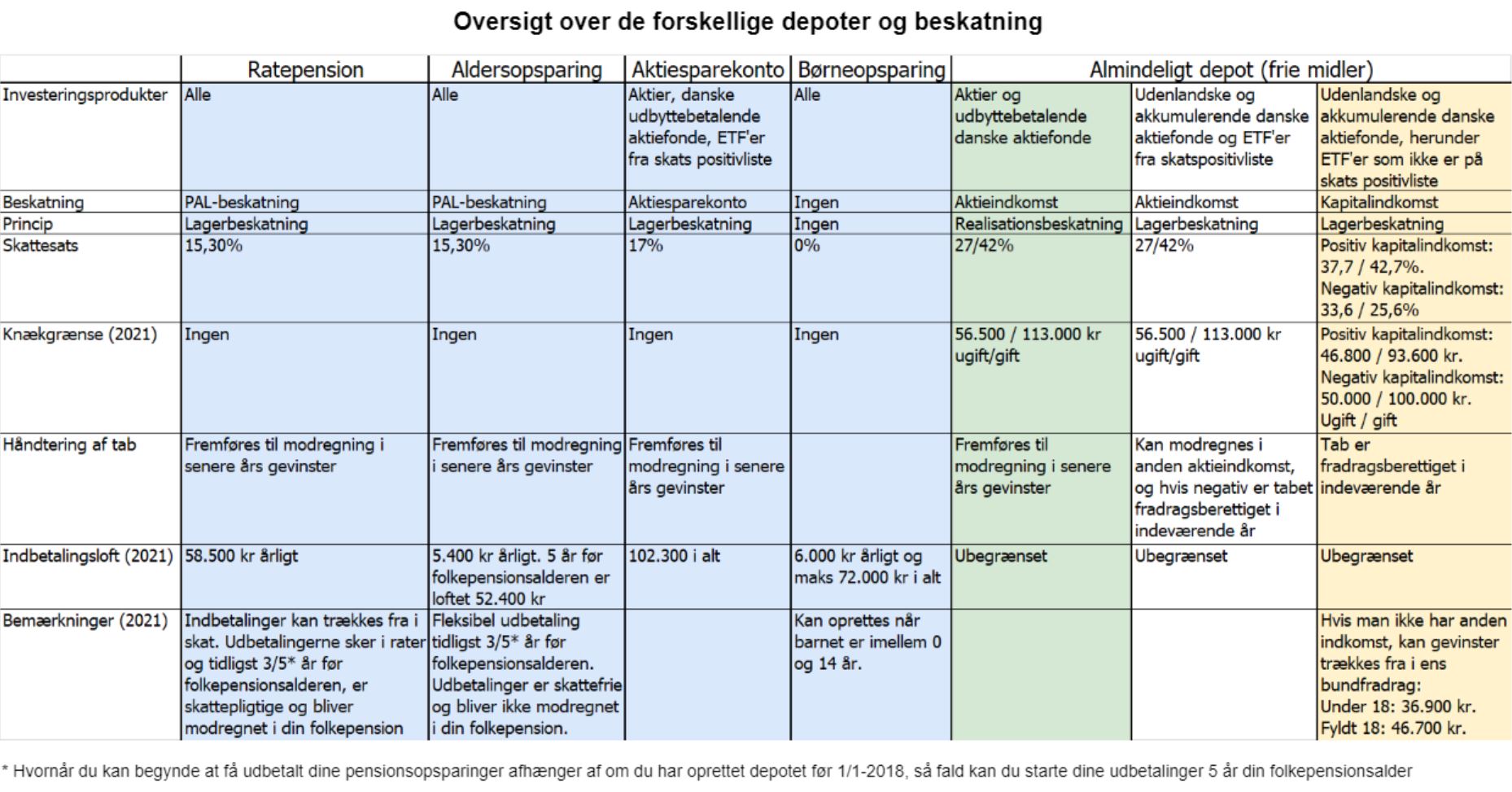

Courtesy of Neovitami

What should I invest in?

What types of investment products should be picked mainly depends on which account is in consideration:

As the Aktiesparekonto, Aldersopsparing, Ratepension and Børneopsparing are always taxed through the lagerprincip, it would be most advantageous to invest in ETFs (for most people) as these investment products are always taxed through the lagerprincip. Dividend-paying mutual funds which are normally taxed through the Realization Principle does not apply in these investment accounts and therefore do not have any benefit to them.

For frie-midler (regular investment account) there is an ongoing debate on whether or not it is more beneficial to invest in ETFs (taxed every year) or danish dividend-paying mutual funds (taxed on sale) - The dilemma lies in the costs of the investment products. ETFs generally have lower expense ratios than danish mutual funds, the debate is therefore whether or not the more benefical taxation method can subsidize the higher expense ratios that comes with the danish mutual funds.

Some individuals have attempted to simulate a senario using real world data to find the superior method when it comes to the two strategies.

TL;DR: The general conclusion is:

< 12 years :

ETFs are better

> 12 years :

Danish dividend-paying mutual funds are better

This is a simplified conclusion as there are a lot of factors which determine which strategy is better. Some Danish mutual funds pay out a large amount of their returns as dividends, which also affects which strategy provides a better outcome.

FAQ

Which bank should i use to invest with?

Different banks have different commissions when it comes to buying and selling stocks, also some banks don't have investment platforms and therefore makes it harder to invest with

- some banks also don't have the option to make an aldersopsparing or aktiesparekonto - some banks also don't fill out tax information which means you have to do it yourself (Annoying and takes a long time)

For Danish residents it is generally best to make an account in both Saxobank and Nordnet

EDIT: Nordnet have announced that they are coming with support for an aktiesparekonto in Q3 of 2021, when this happens, there can be made a strong argument for dropping Saxo Bank and only using Nordnet

Saxobank:

Pros:

- Ability to create an Aktiesparekonto (ASK)

- Automatically fill out tax information

- Low commissions

- Nice trading platform

Cons:

- No Pensionsopsparing

- No free trades a month like Nordnet (Månedsopsparing)

Nordnet:

Pros:

- Ability to make pension funds

- Automatically fill out tax information

- Nice trading platform

Cons:

- No Aktiesparekonto

- Higher minimum investment amount

Which tax advantaged accounts should i fill up first?

Generally, it depends on the individual person when it comes to filling up different tax advantaged accounts - This is due to some accounts locking in your funds until a certain date, such as your ratepension and aldersopsparing, where a fee is charged to withdraw your funds before the target date.

Fee to withdraw funds before target date (Retirement) (Aldersopsparing) 20% of all funds in the account

Fee to withdraw funds before target date (Retirement) (Ratepension): 60% of all funds in the account

This does NOT count for death prior to retirement nor early retirees

Strategy to optimize skat payment / getting the most out of your money

- Fill up your aldersopsparing (5,400 DKK max / 2021)

- Fill up your aktiesparekonto (102,300 DKK max / 2021)

- Fill up your Ratepension (58,500 DKK max / 2021) (IF YOU DON'T PAY TOPSKAT - SKIP THIS PART)

- If you have kids, start a børneopsparing and max it out (6,000 DKK a year / Max 72,000 DKK in total)

- Invest in friemidler (regular investment account)

Lazy portfolios - What is it?

A lazy portfolio is a portfolio which uses basic asset classes, normally split between bonds and stocks. These portfolios are passively traded rather than actively traded. Multiple studies show that passively managed portfolios outperform actively managed portfolios in the long run, and therefore is preferable. There are various different kinds of lazy portfolios,

each adjusted based on fitting the needs of the individual investor. Most lazy portfolios generally follow a broad index and therefore do not take idiosyncratic risks of specific sectors or countries. This means the lazy portfolio takes on the market risk and therefore also the risk premium of the market- but not extra uncompensated risks.

Examples of lazy portfolios:

One fund US portfolio (This portfolio is not diversified over multiple countries and is generally not recommended)

100% invested in a US total market index fund

One fund “World” portfolio 100% invested in MSCI ACWI / FTSE All world index fund (Developed and developing markets) (This portfolio contains most global equity which means you are diversified over all countries and sectors - Generally recommended for most investors)

100% invested in a Global market index fund

Investing money for kids

Investment guide is not complete yet - There can and will be mistakes with information, small spelling mistakes, and general layout of the guide

Also some things might not be finished at all yet

Updated at: 2/5/2021

Courtesy of Neovitami

Courtesy of Neovitami